Hello there, this is tradingpedia.com and this video belongs to the money management series that we have started here quite some time ago. It refers to how to plan the trading week ahead, as always, a good saying is “plan your trade and trade your plan”.

Overview

Sometimes the market moves so fast that we traders need to change the original plan, but it is always helpful to know how to react quicker or to better manage the risk when there is the need to do so.

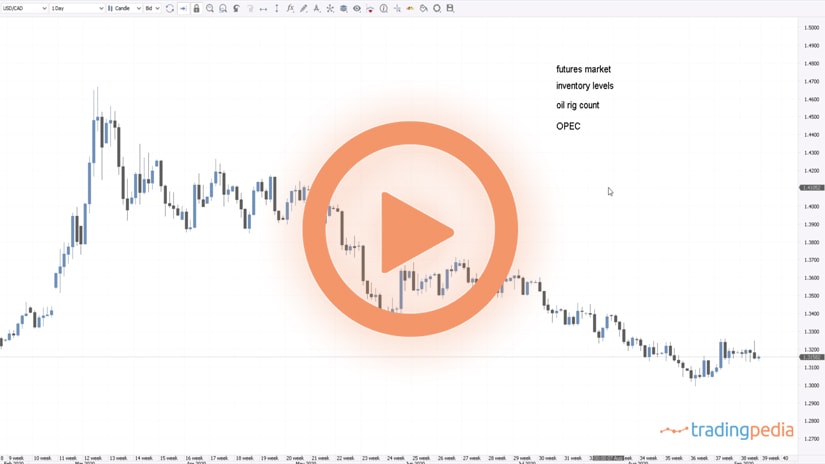

The week ahead is very important and should be on every trader’s mind. Because the currency market closes at the end of the trading week, every five candlesticks the market closes. I’m not counting here the Sunday candlestick – if you broker shows the Sunday candlestick make sure you understand what it means and you do not count it when you look at the week ahead and try to interpret prices.

This is the price action for the previous four weeks and on Sunday or Saturday, whenever you have a bit of a free time on your hands during the weekend, that is the best time to make a plan for the week ahead.

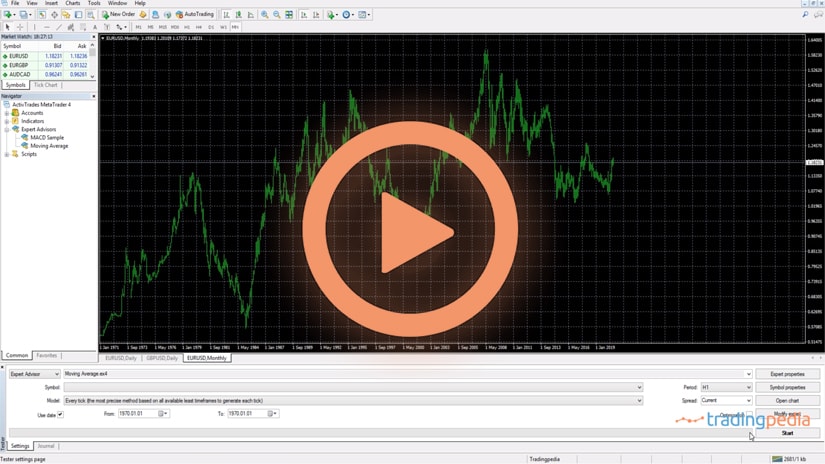

The Economic Calendar

Everything starts with the economic calendar – this is the first thing to consider. It affects all traders – scalpers, swing traders or investors. Scalpers want to know if there are first-tier economic events to come out next week, marked with the red color on every economic calendar. For instance, the Non-Farm Payrolls in the United States, the jobs data in Canada, or the interest rate decision in Australia.

Like it or not, this is where the market moves, and this is the time when opportunities exist. So, the first thing to check is the economic calendar.

If, for example, you are cornered by the market a bit, and if you are a swing trader or investor having positions open over the weekend it always helps to know what lies ahead.

The best example comes from this week. On Wednesday, on this candlestick, it was the FOMC Statement. But last Thursday it was the ECB interest rate decision here. So traders focusing on the ECB here and forgetting about the FOMC next Wednesday will have a problem positioning on the right side of the market. You may be wrong with the ECB but then the Fed comes and the bigger picture changes.

Also, before the ECB week it was the Non-Farm Payrolls week. Therefore, it is worth knowing that when you trade the NFP and you take a position a day earlier, you may want to know what lies ahead, beyond the NFP.

Therefore, always check the economic calendar in order to plan properly your next trades. Because the currency market is correlated, events on the week ahead affect all markets that you want to trade.

For example, this week, yesterday, the Bank of England delivered its interest rate policy and it mentioned that it is actively looking at negative interest rates. Imagine that the bank acted on it and you did not know the BOE is due on Thursday. But because you did, as you planned the trading week ahead, you might want to avoid trading the GBP ahead of Thursday’s announcement.

Or, this week on Wednesday, it was the FOMC Statement. It is always a wild card to trade the FOMC Statement or the USD because the market swings are all over the place. Therefore, it would be a good decision to trade cross pairs. Namely, crosses are currency pairs that do not have the USD in their componence.

Consider The Currency Pair To Trade

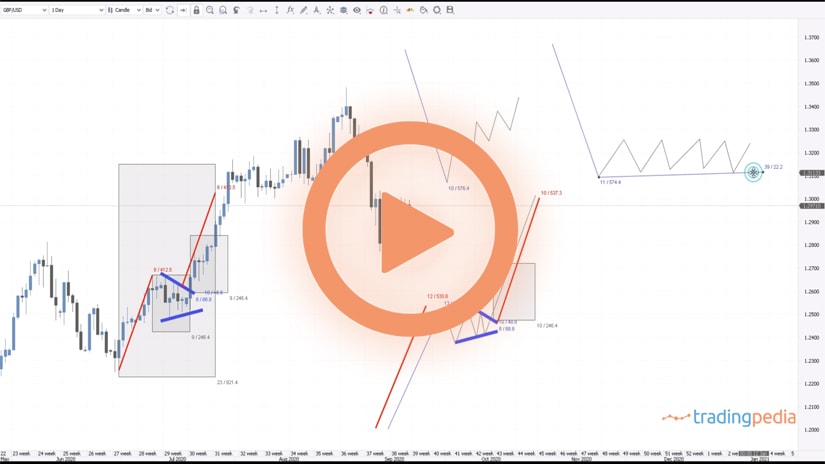

Based on the economic calendar, the second thing to consider is the currency pair to trade. Regardless of the trading strategy, you have a bias and you will want to position in such a way that your trade has a risk-reward ratio and money management that makes sense and helps the trading account to grow.

To do that, it doesn’t mean that it is mandatory to trade your currency pair next week. If there are no specific events and the market does not reach certain levels, maybe there is no entry. No problem. But based on your analysis, you know the currency pairs you want to trade and also know the economic events ahead. The two, coupled, reinforce the analysis. Basically, one is technical and the other one fundamental analysis and they work together to provide the best trade.

Consider The Risk-Reward Ratios

Last but now least, consider risk-reward ratios. Let’s say that I am bearish USDJPY based on a contracting triangle that broke lower recently. And then I check the economic calendar at the end of every week and see that there are no important economic events.

I’m bearish and waiting for the market to make a new low and I see that the pair forms the b-d trendline and then it moves higher, reaching the a-c trendline. During this week, the NFP week, the USDJPY reached the upper edge of a triangle – a great place to go on the short side.

However, if you go on the short side here you must have a proper risk-reward ratio because you don’t know how the market reacts. Such a ratio needs a stop-loss and a take-profit that exceeds the risk by a minimum 1:2 or 1:3 and you project it to the downside. That would be one way to use rr ratios.

But let’s say that the market moved like this, so what are we going to do now? Should we exit or keep the position open for next week as in Japan there is a new Prime Minister, Suga, increasingly popular. Maybe the rally will continue next week, and a wise move would be to move the stop-loss to the trendline as the market may come to retest it.

Related Videos

Conclusion

To sum up, to plan the trading week, make sure you check the economic calendar. Next, check the currency pairs you want to trade and choose your trades based on risk-reward ratios. Don’t be afraid to move the stop to break-even because if you will do that, you will free margin for your next trade.

Thank you for being here, bye, bye.