Hello there, this is tradingpedia.com and this video shows what are impulsive waves and what to consider when trading impulsive waves. We already introduced the concept of the Elliott Waves Theory and what it stands for. Back in 1930s, Ralph Elliott developed a theory and according to it, the market moves in cycles, or waves, as the name suggests.

Impulsive and Corrective Waves Theory

The theory is based on impulsive and corrective waves. To count impulsive waves, one uses numbers, and to count corrective waves, one uses letters.

An impulsive wave has a five-wave structure: 1-2-3-4-5. Let’s try to label the structure with numbers. This is the first wave, the second wave, the third, the fourth, and the fifth.

Out of these five segments, three are impulsive: the 1st, the 3rd, and the 5th. One of the first things to consider when interpreting an impulsive wave is that the 3rd wave cannot be the shortest.

If you will have a third wave, for example, like this, and the 5th like this, this is not possible because the 3rd is the shortest. However, it cannot be the shortest when compared with other impulsive waves in the structure.

Any impulsive wave must have an extension. Therefore, look for the extended wave. The minimum distance for the market to extend is 161.8% when compared to the next longest wave.

All we have to do is to check the length of the 1st and 5th waves, calculate 161.8% of the longest one, by using a Fibonacci Retracement or Expansion tool, and then compare the third wave with it. If the 3rd wave exceeds the 161.8% level, you have an extension. If the 3rd wave does not exceed 161.8%, the entire pattern is not an impulsive wave.

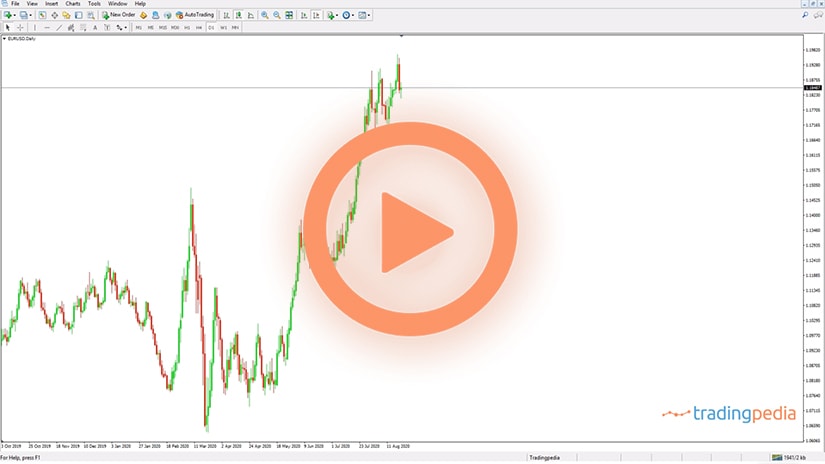

For instance, this is a move that does not qualify as an impulsive wave. For instance, if you see such a market move and someone labels it as an impulsive wave, that is not possible. If you take a Fibo tool and measure the 1st wave and apply the 161.8% on the 3rd wave, there is no extension, and that is not possible in an impulsive wave.

An impulsive wave does not channel. This move here, at the bottom right, channels very well. That is a characteristic of corrective, not impulsive waves.

The 1st wave can also extend, forming a first wave extension and also 5th wave extensions exist. How does a first wave extension looks like?

Well, the 1st wave is more than 161.8% of the 3rd wave. Even in such a case, the 3rd cannot be the shortest when compared with the length of the 1st or the 5th. All the rules are respected. How do we check for the extension?

This time, we measure the 3rd wave, we take 161.8% out of it and project that outcome over the 1st wave. If the 1st wave is longer than 161.8% of the third wave, then you have the extended wave. If not, that is not an impulsive wave.

The last possibility is that the market forms a 5th wave extension when the 5th is the longest and the 3rd is not the shortest.

One more thing on impulsive waves – actually two things. Overlapping between the corrective waves is not possible. You should focus on the 2nd and 4th waves. If the price action on the 4th wave comes into the territory of the second wave, that means overlapping – not allowed in an impulsive wave.

Principle of Alternation

Another thing to consider is the principle of alternation. It states that corrective waves should differ at least in one of the following – price, structure, complexity, distance, and so on. So the 4th wave should differ from the 2nd wave. If the 4th wave was complex in structure, look for the 2nd wave to be simple, and the other way around.

I still want to show you a possible 5th wave extension. It looks like this – 1, 2, the third wave like this, the fourth wave is not overlapping, and then the 5th wave extends in such a way that the market will not channel.

Remember – no channeling is possible with impulsive waves.

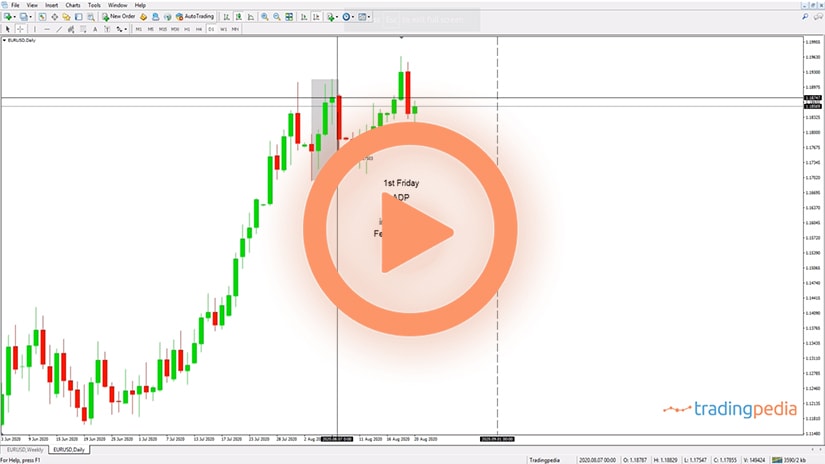

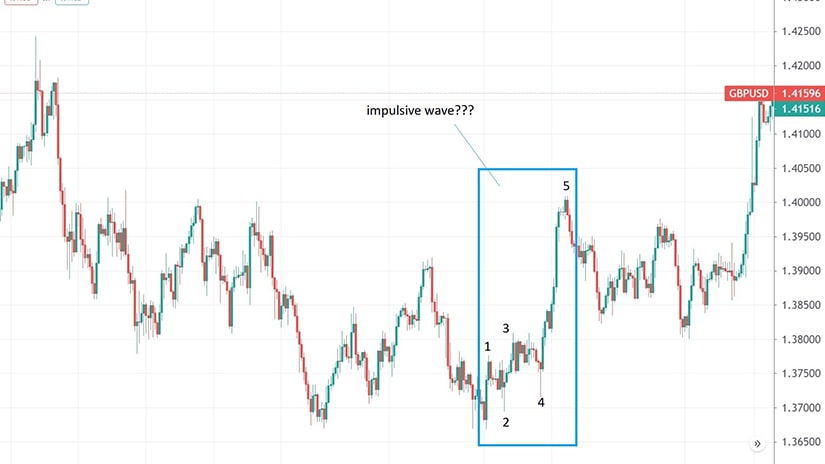

Is possible for this move on the GBPUSD to be an impulsive wave? This can be the 1st wave, this the 2nd wave, here is the 3rd, the 4th here, and then the 5th wave here. Normally we should check the extended wave if we do have an extension. We take a Fibo tool, find the 161.8% level and project it on the 1st wave.

Is this more than 161.8%? I would say yes. Therefore, an impulsive wave applies here. There is no overlapping, and the 2nd and 4th waves alternate. The 2nd wave takes more time than the 4th wave, the 2nd wave is more complex than the 4th one, so the principle of alternation is also respected.

Related Videos

Examples of Impulsive Waves

The Elliott Waves Theory is all about impulsive and corrective waves. That’s it; this is what the analysis should focus on.

But the problem is that counting waves according to the Elliott theory is more complex than it appears at first glance. The basic assumption is that the market moves in waves – impulsive and corrective.

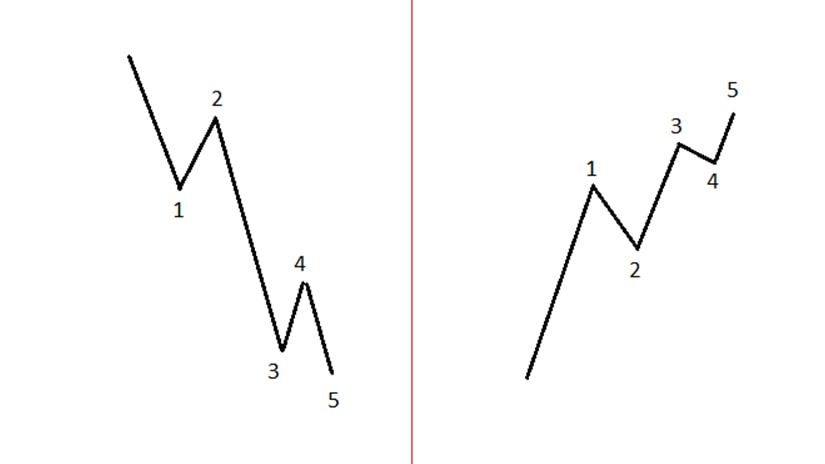

More precisely, Elliott traders check the charts to find five-wave structures (i.e., impulsive waves) and three-wave structures (i.e., corrective waves). From an impulsive wave point of view, a theoretical representation looks like below -on the left side, you can see a third wave extension impulsive move, and on the right side, a first wave extension.

Other types of impulsive waves exist, too, such as the fifth-wave extension, the double extension, or the terminal impulsive wave. But they all have at least a few things in common.

First, all impulsive waves are labeled with numbers. Because the structure has five segments, or waves, the labeling is 1-2-3-4-5.

Second, all impulsive waves need an extension. Effectively, it means that one of the segments must extend. Extension means that at least one wave must exceed 161.8% of the next longest wave. Once again, Fibonacci ratios establish the rules in the Elliott Waves Theory.

Third, all impulsive waves have at least two corrective segments. In a classic impulsive wave (i.e., the first, third, and fifth wave extension), the second and the fourth waves are corrective. Things get even more complicated in a terminal impulsive wave. Despite the fact that numbers are used to label the structure, all segments are corrective.

Finally, the third wave must never be the shortest in the pattern.

Third Wave Extension Impulsive Structure

All of the above are just a few of the rules that an impulsive structure must follow. Others exist too, such as the principle of alternation, the overlapping rule, or the equality rule, and they are covered in other topics part of this section of our website.

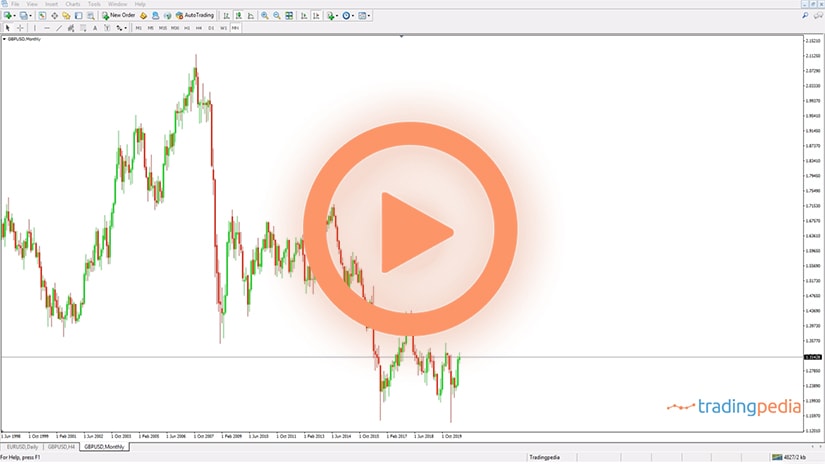

The best way to illustrate how to count waves with the Elliott Waves Theory is to use examples. Below, you can see the recent GBPUSD 4h chart. The time frame is large enough to warrant the use of the Elliott Waves Theory, as it is not recommended to count waves on the smaller timeframes.

Starting from left to right, can we count a five-wave structure?

We see the market forming a five-wave structure, with the third segment the longest one. As seen below, the five-wave structure is called a third-wave extension.

Effectively, it means that the third wave is the longest one in the structure. Also, it must be longer than 161.8% of the next longest wave. But that refers only to the other impulsive waves, of a lower degree, in the structure. More precisely, it refers to the first or the fifth wave. Whichever is the longest, simply calculate 161.8% and compare it with the third wave. If the third wave is longer, the overall impulsive wave extends.

Fifth Wave Extension Impulsive Structure

The next example is a fifth wave extension impulsive wave. Also, it forms on the same chart – the GBPUSD 4h timeframe.

In a fifth-wave extension, the fifth segment is the longest and it must extend. Remember the extension rule – minimum 161.8% of the next longest wave. But in this case, the next longest wave is the third wave, so that is the segment to consider.

A close look at the count below reveals that all the rules of an impulsive move are respected. First, the third wave is not the shortest in the structure. Second, the fifth wave is longer than 161.8% when compared to the third wave (i.e., the next longest wave). Third, there is no overlapping between the correcting waves.

Overlapping refers to the corrective segments part of an impulsive structure. That is, the second and the fourth waves.

Also, overlapping considers the entire market move after the corrective waves started. It means that no parts of the second wave should enter the fourth wave’s territory.

The simplest way to check this out is to mark the highest and the lowest levels in both ways, and make sure there is no interference between the two areas. This way, the overlapping is avoided.

How about the principle of alternation? According to it, the corrective waves part of an impulsive structure (i.e., the second and the fourth waves) should be different.

Effectively, Elliott traders should consider aspects such as time, price, and structure. Namely, the time it took for the two corrective waves to form should be different. Also, the distance the price traveled, should be different as well. Finally, the structure of the corrective waves should be different too – ideally, if one is a simple correction, the other one is a complex correction.

Avoid Overlapping

Now that we have covered two examples of impulsive waves, how about the example below? Is it an impulsive wave or not?

Judging by the structure, it is very easy to interpret it as an impulsive wave. However, there is one trick, already explained earlier – overlapping.

A close look at the structure reveals that the fourth wave enters the second wave’s territory, which is not allowed in any impulsive wave, unless the impulsive wave is terminal. But this is not a terminal impulsive move. To be terminal, the price action that follows the five-wave structure should fully retrace the entire pattern in less than half of its time. Because it did not happen, we can discard a terminal impulsive wave structure too.

Summing up, impulsive waves have five segments, labeled with numbers. In a classic impulsive wave, only the first, the third, and the fifth ones are impulsive. The other two are corrective.

Also, in a terminal impulsive wave, all segments are corrective, despite being labeled with numbers. More about that in a future video here on tradingpedia.com.