Hello there, this is tradingpedia.com and this video deals with one of the most controversial concepts part of the Elliott Waves Theory, called a running correction. It is a concept that not many traders use, for the simple reason that they are not aware of it.

Rules

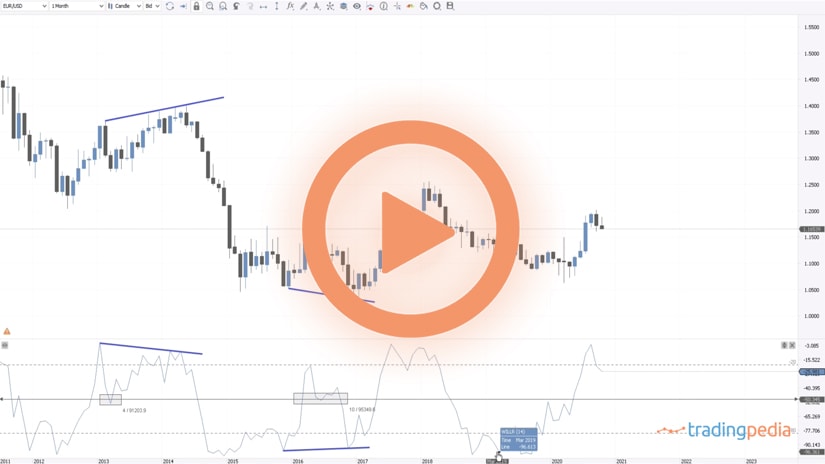

The concept of a running correction is based on the following. In an impulsive wave, we know that the market travels in five waves – 1.2,3,4,5. In an impulsive wave we must have the principle of alternation between the two corrective waves, different length in price and time between the first and the fifth waves, if the third is the longest one, we must have one extension. Also, the 0-2 trendline should not be pierced by any parts of the first or third wave, and so on.

All these rules must be respected in a classic impulsive wave. A correction that runs refers to the corrective waves within an impulsive move, namely, in this case, the corrective waves will be the second wave and the fourth wave.

Corrective Waves

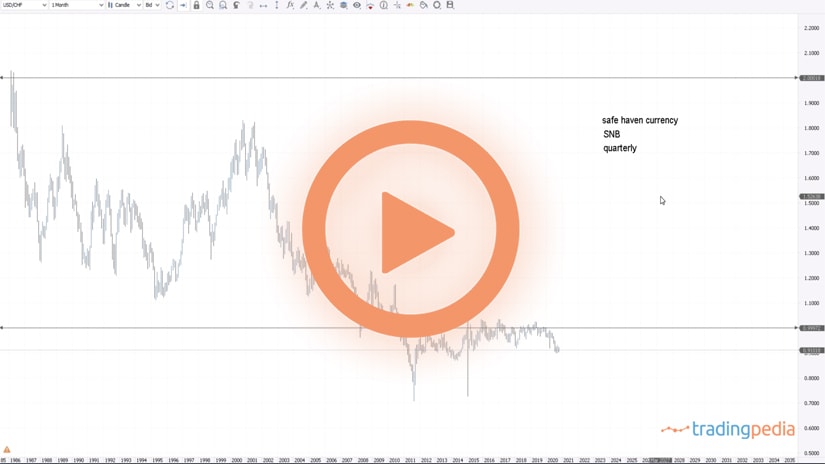

But also a running correction may appear during a corrective wave in a zigzag. A zigzag is a three-wave structure that is characterized by two impulsive waves for the first and the last segment, and a corrective segment for the b-wave. A running correction might happen as the corrective wave of a zigzag.

These are the places were corrective waves happen almost always. Out of these possibilities, we should emphasize that we will likely see a running correction as a second wave of a classic impulsive move or as the b-wave of a zigzag. This happens 80% of the times, and this one only 20% of the time.

Running Correction

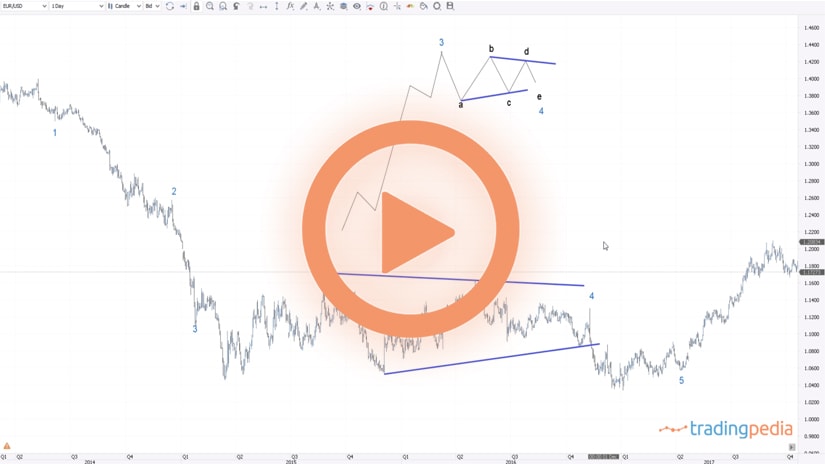

What is a running correction? Imagine this 1-2-3-4-5 impulsive structure, as labeled here. In this case, this would be wave a, and this the c-wave.

The concept of a running correction implies that in a bearish move, the correction ends below the end of the previous segment. In this case, the running correction ends below the end of the first wave.

In other words, not like this, when the second wave ends into the territory of the first wave, but much lower. In a running correction, we will have the first wave, then the market goes with an a-b-c, and x-wave, and then a possible triangle. This is the end of the second wave, below the end of the first wave, and this is the place where the third wave starts so the extension applies from here. This would be the third wave, and then the fourth and the fifth.

The only difference between the two impulsive waves is that the second wave ended below the end of the first wave. Multiple types of running corrections exist, and we will cover them in future videos on tradingpedia.com – double three running, triple three running, double and triple running flats, and so on.

What is the difference between two impulsive waves, one with a classic and one with a running correction? The difference is that an impulsive wave is longer in the case of a running correction.

Related Videos

An Example

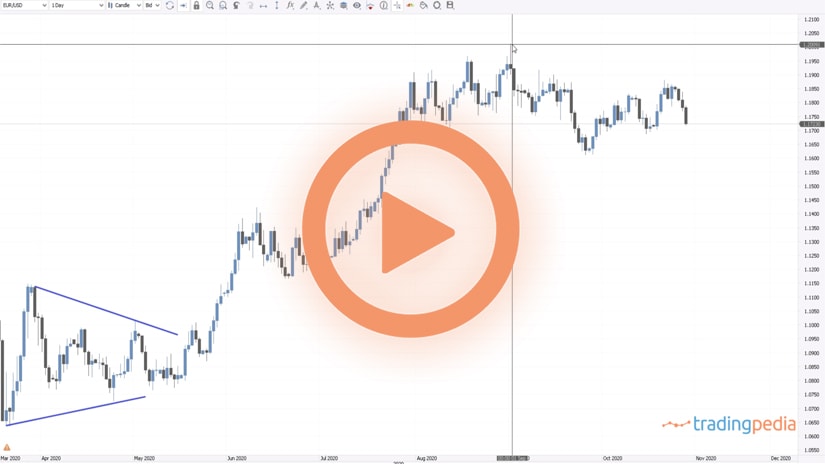

This is the GBPUDS on the 4h chart and it rallied in 2020 from 1.15 all the way to 1.35 and then it fell. If you believe that this is an impulsive wave or a five-wave structure, how would you label it? Many traders will say that this is the first wave, here the second, and then the next three waves. However, the problem is that the fifth wave equals the length of the first wave, and that is not possible in an impulsive wave because the two must differ.

It might be possible, though, that the GBPUSD formed first wave here, and then had a running correction for the second wave. Then the extended wave followed, so this would be our third wave. Next, a small fourth, and then the market makes a new low with the fifth wave.

You might say that this is not possible because this is too big when compared to the other waves part of the impulsive structure. However, it is possible, because the currency market spends most of the time in corrective waves, and they do not refer only to horizontal corrections. Running corrections are not horizontal. In fact, running corrections are formed out of zigzag family patterns, where the intervening x-wave is a double or a triple zigzag. In a triple zigzag, for instance, we have six different impulsive waves of a lower degree, so that is quite an aggressive market move.

This is just an introduction of the concept of a running correction and we will go into more details in future videos. Thank you and have a great day – bye, bye.