Hello there this is tradingpedia.com and this video deals with overbought and oversold levels in technical analysis. This is a concept that applies to almost all oscillators, because oscillators usually come with a predetermined overbought and oversold level.

Different Situations When Trading

The standard interpretation is that we, as traders, should sell when the oscillator reaches overbought levels or we should buy when it reaches oversold levels. But, as you will found out later, this is not always true. The aim is to make a distinction between different situations when trading.

This is the RSI applied on the 14 period meaning that on this 4h chart it uses previous 14 4h candlesticks in order to plot these values here. Whenever you deal with an oscillator, keep this in mind – wait for the candlestick to close. Otherwise, the oscillator is said that it is “painting”. It means that if the EURUSD moves to 1.20 in the next hour and comes back to 1.19 before the candlestick closes, the RSI will not reflect that move.

The reason that we use the RSI is that it is the most popular oscillator. The RSI comes with 70 and 30 levels and they are overbought, respectively oversold. In other words, every time the price reaches the 70, we should sell, go short, and every time it reaches oversold, we should buy, go long.

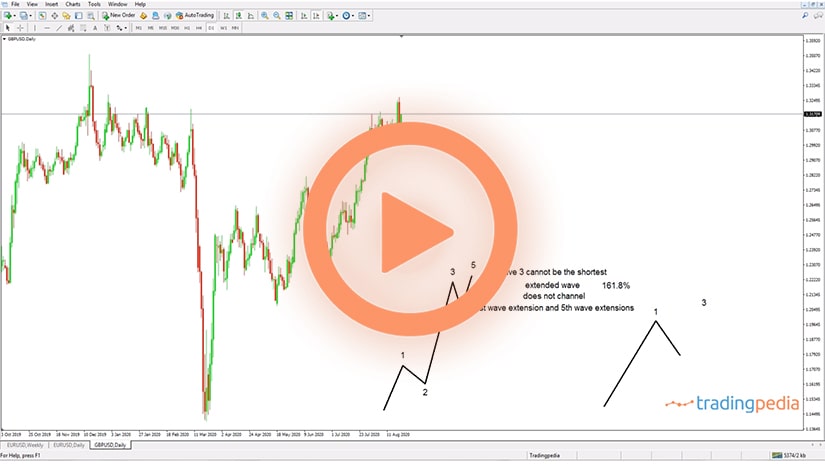

This works well in ranges, but you will be surprised to find out that the strongest trends in the market take place in overbought or in oversold territory. It is not by chance that I picked the EURUSD to illustrate that, because the EURUSD is on a rising trend since March 2020 and now we are in August 2020, almost September.

The market advanced and almost reached the 70 level, the overbought territory. So we should go short according to the standard interpretation. Then the market declined, and by the time it reaches oversold we are supposed to go long. All good, and we repeat the same thing every time it reaches the territories.

But the danger here is that you will become complacent. Complacency means that you simply wait for the market to reach a certain level before going in or out, without paying attention to the actual price action. Because if we do, we note a range here – between 1.10 and 1.0765, a range for the EURUSD. As long as it held, the classic interpretation worked.

However, at the moment that the market broke higher and the EURUSD reached again the overbought territory, going short is not doing so well because the EURUSD rose from 1.08 to the current 1.19 without a pause. Namely, it did not reach the oversold territory anymore. If you sold the overbought and waited for the RSI to come close to the oversold level, the difference would be quite stunning, a few big figures. How to solve for this issue?

An Example

One way is to wait for the oscillator to break below or above the level. For instance, it closed above overbought and this would be a possible bullish break, not bearish, because during strong trends the market remains overbought. So we simple wait for the RSI to drop into the second half and avoid going short until the RSI breaks below the 30 level.

Unless it does that, the bullish trend keeps going. If there is no oversold and everything looks overbought, the market remains overbought and the strong trend continues. This is how you make the most of strong trends with any oscillator not only with the RSI.

Let’s apply a different oscillator on the chart. Let’s take the indicators list, delete the RSI and apply the DeMarker. It is similar with the RSI but instead of 70 and 30 it shows 0.7 and 0.3 and the maximum value is 1 and the minimum is 0.

The difference between the two is that DeMarker travels into overbought and oversold more frequently than the RSI does. It allows you to pick overbought and oversold levels easier. For instance, this is a bearish break, we are supposed to buy, then the market comes into overbought but remains like this all the way to here – so selling is not wise. We should wait for the oscillator to break below before going long.

Related Videos

Sum Up

These overbought and oversold are often appearing on most oscillators and just keep in mind that buying oversold and selling oversold works very much when the market is ranging. But when it doesn’t, overbought shows very strong bullish conditions, and oversold shows very strong bearish ones.

Thank you for being here, bye, bye.