Hello there, this is tradingpedia.com and we continue the series on gold trading. Our last video dedicated to how to trade gold deals with gold on MetaTrader. This is the MT4 offered by an FX broker and shows the EURUSD on the hourly chart, right before the North American trading session starts.

Check the Offer of Your Broker

Whenever you have an FX broker account, you must check the offer of that broker under the Market Watch. The first thing to do is to right-click and choose to display them all. These are all the markets offered by this broker. As you can see, there are many other markets not only FX, like silver, gold, Dow Jones, Dax, futures contracts like corn, cotton, and so on.

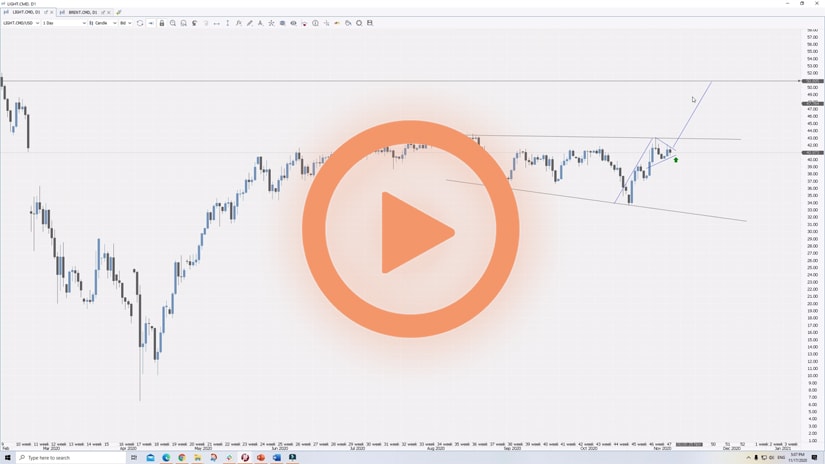

Gold is present here as well. If we click and drag on the chart, we have the price of gold displayed on the main chart window. If we want to analyze the info and the chart and to interpret it, we must customize it a bit.

We first change the foreground and then the candlesticks’ color. On the Common tab, we want the chart to shift and not the Autoscroll. We see that the chart keeps coming to the current price otherwise, and we do not want to do that.

Monthly Chart

Let’s move it on the monthly chart. On the monthly chart, we see data all the way to 1996. But what we said earlier is that gold existed for way longer than this chart shows. The point of this video is that if you decide to trade the CFD with an FX broker, you want to make sure you understand the costs of doing so.

Therefore, we should choose the product (i.e. gold), and check the Details tab on smartphone or Specifications on desktop. The spread on gold tells us that this is free floating. Digits – two digits. If we look at the price of gold, 1865.65, so two digits. Contract size is 100, meaning that you are limited at this volume. However, you can use multiple trades. For instance, one time 100 lots, and then another, and so one. But I personally do not know any retail trader that affords to trade 100 lots of gold and still uses CFDs with an FX broker.

Related Videos

What The Swap Shows

The most important part that I wanted to mention is that a swap long on gold is -9.3 and a swap short is -2.18. What does it mean? A swap shows the interest rate differential between two currencies part of an exchange rate. In a normal currency pair, like the EURUSD, you will have central banks setting interest rates and the swap is easier to calculate. However, we can calculate it on gold as well.

If you end up being long gold and keep the position overnight and roll it to the next day, the broker deducts a negative swap from the balance of the trading account. The funny thing is that the broker will do the same in the case of a short position. Moreover, the bigger the volume traded, the bigger the swap, because it adjusts with the volume.

Therefore, if you want to invest in gold, you do your analysis and then the CFD is not the contract you want to use because of the costs associated. Another way is to trade ETFs that follow the price of gold. Or, simply own the physical gold.

Because this is the daily chart, we may even do the math and make a comparison between costs and see which method is more advantageous.

Let’s move on to the next part – bye, bye.